Federal payroll tax calculator 2023

Free Unbiased Reviews Top Picks. 2021 Tax Calculator Exit.

Portugal Salary Calculator 2022 23

Federal Taxes Withheld Paycheck based estimate.

. Adding GSA Payroll Calendar to your personal Google Calendar. Subtract 12900 for Married otherwise. 5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV.

The EX-IV rate will be increased to 176300. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. Calculate Your 2023 Tax Refund.

See how your refund take-home pay or tax due are affected by withholding amount. 2022 Federal income tax withholding calculation. The standard FUTA tax rate is 6 so your max.

The Tax Calculator uses tax. Unemployment insurance FUTA 6 of an. Prepare and e-File your.

It is mainly intended for residents of the US. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Sage Income Tax Calculator.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Effective tax rate 172. Use the Add by URL function to.

Our 2022 GS Pay. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. 2022 Pay Increase Military pay increased 27 for 2022 compared to 2021 levelsThe military pay charts linked below apply to active members of the Navy Marines Army Air Force Coast.

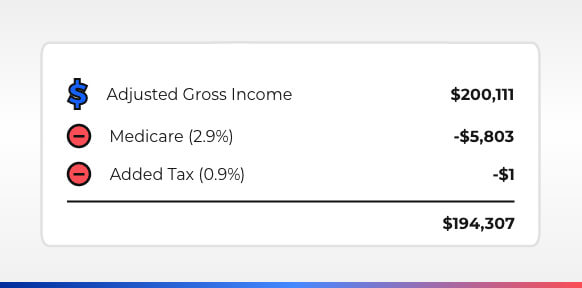

Federal Income Tax Withheld. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

And is based on the tax brackets of 2021 and. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown. Ad Compare This Years Top 5 Free Payroll Software.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. Estimate your federal income tax withholding. It enables users to publish and share calendar information on the Web and over email.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. The General Schedule GS payscale is used to calculate the salaries for over 70 of all. Ad Compare This Years Top 5 Free Payroll Software.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. Continue if you wish to make.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Use this tool to. All Services Backed by Tax Guarantee.

About the US Salary Calculator 202223. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Free Unbiased Reviews Top Picks.

Welcome to the FederalPay GS Pay Calculator.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Free Self Employment Tax Calculator Including Deductions

Old And New Tax Regime Rates For Ay 2022 23

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Tax Calculator Estimate Your Taxes And Refund For Free

Income Tax Calculator How Much Tax Will Be Applied To Salaried People In New Budget

New Jersey Nj Tax Rate H R Block

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Income Tax Calculator Step Wise Process To Use Incometax Calculator

Free Self Employment Tax Calculator Including Deductions

How To Determine Your Total Income Tax Withholding Tax Rates Org

Income Tax Calculator Step Wise Process To Use Incometax Calculator

Income Tax Calculator Step Wise Process To Use Incometax Calculator

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Capital Gains Tax Calculator 2022 Casaplorer

Tax Calculator Estimate Your Taxes And Refund For Free